There's a lot to know as a First Time Home Buyer (FTHB)

Resources for First Time Home Buyers

Secure Online Application

Fast, Secure, & Commitment Free

The only way to really know what a bank or lender would qualify you for, is to submit and online application using our fast and secure online application. We can

- Review and verify your income documents

- Check your credit

- Give you a real budget to shop for

Or if you aren't quite ready, we can discuss strategies to get you there. But it all starts with an online application.

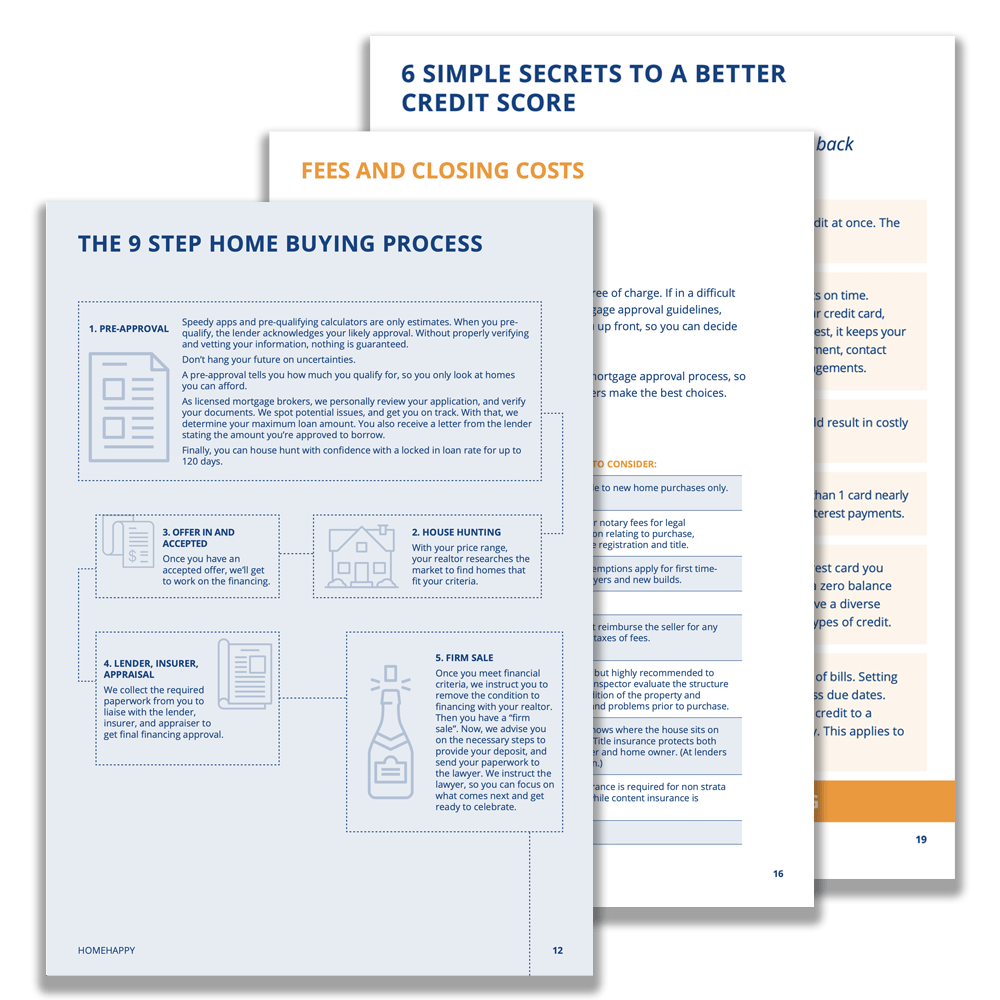

FTHB Guide

All-in-one Resource

There's a lot to know as a First Time Home Buyer. This guide has it all!

- Learn the 9 step home buying process

- Watch informative videos

- Learn how to repair credit

- & More

Home Buyer's Plan (RRSPs)

Use RRSP savings for a Downpayment

Pay back funds over 15 years

For qualified first time homebuyers, you can use your RRSP savings to buy or build a qualifying home for yourself or for a related person with a disability.

Federal FTHB Incentive Program

To help you purchase your first home

Government of Canada Incentives

Help qualified first-time homebuyers reduce your monthly mortgage carrying costs without adding financial burden.

Mortgage resources about homeownership

4 Signs You’re Ready for Homeownership

If you’ve got at least 5% saved up for a downpayment, if you’ve established your credit profile, and you have the income to support mortgage payments, the best place to start the home buying process is with a preapproval. Learn more about the path to homeownership here.

Unsure About The Housing Market? Let's Talk.

There’s no doubt that buying your first home can be stressful, but it doesn’t have to be. Having a plan in place is the best course of action to help you make good decisions and alleviate that stress.

Learn more about getting credit to buy your first home

How to Establish New Credit

If you’re new to managing personal finance and you want to learn about credit, you’ve come to the right place. Establishing credit is simple when you have a plan to follow. Learn more here.

Will Collections Impact Your Mortgage?

Did you know that over 20% of credit reports contain some level of inaccuracy? If you have a collection account outstanding, even if it’s an error, your mortgage application will be held up until the problem is solved. Learn more here.

Learn more about your downpayment

How to save money for a downpayment

The key to saving money is getting clarity - clarity around your income and your expenses, developing and following a clear plan, and seeking help from professionals who can help you see the big picture as well as the details.

Downpayment Options

If you’re looking to buy a property, you’ll be required to come up with at least 5% of the property value for the downpayment. There are several ways you can come up with the funds. Learn more about your downpayment options here.

Difference Between Deposit and Downpayment

Do you know the difference between the deposit and downpayment? Learn more about these terms as they relate to the home buying process.

Getting the mortgage process started

Protect Yourself with a Pre-approval

One of the biggest mistakes when shopping for property is falling in love with something you can’t afford. Learn more about how a pre-approval can protect you.

Costs Associated with Buying Property

When purchasing property, in addition to the downpayment, you’ll be required to come up with the money to cover closing costs. There’s a lot to consider. Learn more about the costs associated with buying property.

What You Need To Know About Home Inspections

Are you considering buying a new home? Before you sign on the dotted line, understanding the critical role of a home inspector is paramount. In this insightful video, The HomeHappy Team provides a comprehensive introduction to the world of home inspections.